October 13, 2023

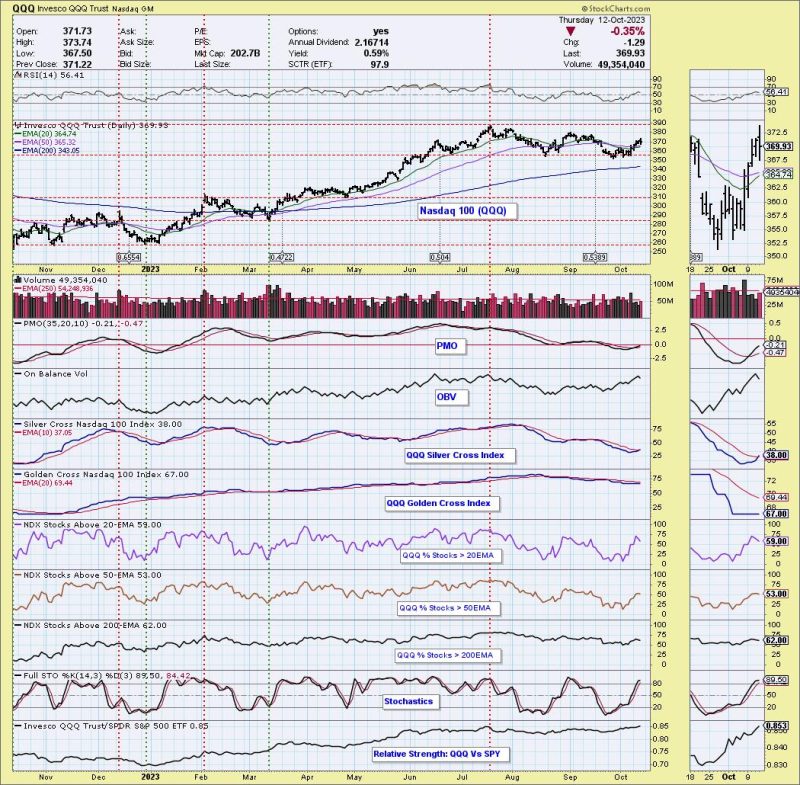

An IT Bull Market: Nasdaq 100, Communication Services, and Transports Lead the Way!

The Nasdaq 100 (QQQ) and its four ETFs – Communications Services (XLC), Healthcare (XLV) & Biotech (IBB), Technology (XLK), and Transports (IYT) – are beginning to show bullish bias. In particular, the Transports Index (IYT) has been seeing an increase in volume and trading activity.

The Communications Services ETF (XLC) has also been seeing a positive trend, with the ETF now trading near its all-time high. Despite the sector’s growth across most of 2020, XLC has been outperformed by the Nasdaq index and some of its sector peers, until now.

The Tech ETF (XLK) has been trending higher also, as its strength in cloud computing and e-commerce continues. Similarly, the Healthcare ETF (XLV) remains a strong performer despite the pandemic, with IBB continuing to rise with the increasing number of mergers and acquisitions in the industry.

Finally, the Nasdaq Transports Index (IYT) has been steadily rising since early October 2020, after experiencing a setback in the spring. The strong economic recovery has provided a significant boost to IYT, and is indicative of the strength of transportation, logistics, retail, and leisure activities in the US.

The increasing activity of investments between the Nasdaq 100 and the four ETFs is indicative of the current market sentiment, and has suggested a likely bullish bias. Investors should be cautious when trading and be aware of risks, particularly in the Transports sector where volatility could be greater than usual.

The Nasdaq 100 (QQQ) and its four ETFs – Communications Services (XLC), Healthcare (XLV) & Biotech (IBB), Technology (XLK), and Transports (IYT) – are beginning to show bullish bias. In particular, the Transports Index (IYT) has been seeing an increase in volume and trading activity.

The Communications Services ETF (XLC) has also been seeing a positive trend, with the ETF now trading near its all-time high. Despite the sector’s growth across most of 2020, XLC has been outperformed by the Nasdaq index and some of its sector peers, until now.

The Tech ETF (XLK) has been trending higher also, as its strength in cloud computing and e-commerce continues. Similarly, the Healthcare ETF (XLV) remains a strong performer despite the pandemic, with IBB continuing to rise with the increasing number of mergers and acquisitions in the industry.

Finally, the Nasdaq Transports Index (IYT) has been steadily rising since early October 2020, after experiencing a setback in the spring. The strong economic recovery has provided a significant boost to IYT, and is indicative of the strength of transportation, logistics, retail, and leisure activities in the US.

The increasing activity of investments between the Nasdaq 100 and the four ETFs is indicative of the current market sentiment, and has suggested a likely bullish bias. Investors should be cautious when trading and be aware of risks, particularly in the Transports sector where volatility could be greater than usual.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry