"Boost Your Portfolio, or Face Long-Term Weakness: Intermediate-Term Participation Levels Are Overbought

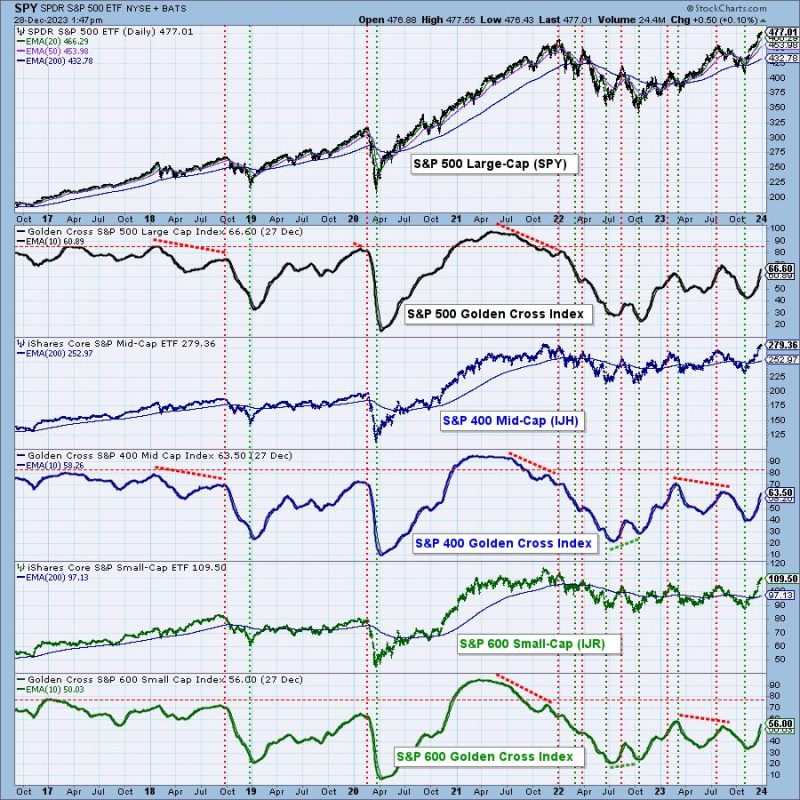

Intermediate term participation levels are a market indicator that measure the enthusiasm level of investors in the stock market - and it looks like the outlook isn't good. According to GodzillaNewz, a new analysis has suggested that the intermediate term participation levels are looking particularly overbought - meaning that investors are too invested in the stock market and their enthusiasm is waning.

This is particularly concerning as investments in the stock market are a long-term proposition and if investors are losing interest then this could be a sign of a looming market crash. As well as being overbought, analysis is also indicating that the participation levels are weak in the long-term - meaning it's unlikely that investors will stick around and remain enthusiastic about stocks for as long as they should for a healthy stock market.

Overall, the outlook is not a reassuring one and could be a cause for concern in the near future. Financial professionals suggest that investors should be aware of this situation and take it into account when making decisions in the market. It's likely that volatility will increase as more investors become jittery and begin to sell off their stocks. Until then, it is important for investors to understand the risks and potential rewards of the current market situation.

Intermediate term participation levels are a market indicator that measure the enthusiasm level of investors in the stock market - and it looks like the outlook isn't good. According to GodzillaNewz, a new analysis has suggested that the intermediate term participation levels are looking particularly overbought - meaning that investors are too invested in the stock market and their enthusiasm is waning.

This is particularly concerning as investments in the stock market are a long-term proposition and if investors are losing interest then this could be a sign of a looming market crash. As well as being overbought, analysis is also indicating that the participation levels are weak in the long-term - meaning it's unlikely that investors will stick around and remain enthusiastic about stocks for as long as they should for a healthy stock market.

Overall, the outlook is not a reassuring one and could be a cause for concern in the near future. Financial professionals suggest that investors should be aware of this situation and take it into account when making decisions in the market. It's likely that volatility will increase as more investors become jittery and begin to sell off their stocks. Until then, it is important for investors to understand the risks and potential rewards of the current market situation.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry