April 12, 2024

Breaking News: Tech Stocks Beyond Mega Caps on the Rise According to RRG Analysis

RRG Indicates That Non-Mega Cap Technology Stocks Are Improving

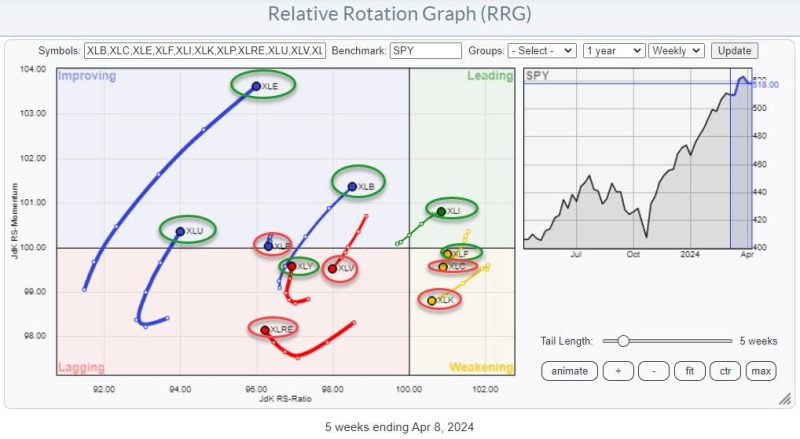

The Relative Rotation Graph (RRG) is a unique charting tool that helps investors visualize the relative strength and momentum of various sectors or asset classes. When analyzing the RRG for technology stocks, it is clear that non-mega cap technology stocks are showing signs of improvement compared to their larger counterparts.

At the forefront of this trend is the increasing demand for niche technology solutions and specialized services. While mega-cap technology companies like Apple, Amazon, and Microsoft dominate the headlines, smaller technology firms are carving out their own space in the market by focusing on specific areas of expertise. These companies are often more agile and innovative, allowing them to tap into emerging trends and meet the evolving needs of customers more quickly than their larger competitors.

Another factor driving the outperformance of non-mega cap technology stocks is the ongoing digital transformation across industries. As businesses and consumers increasingly rely on technology to streamline operations, improve efficiency, and enhance user experiences, smaller tech companies offering specialized products and services are well-positioned to capitalize on this trend. Their ability to provide tailored solutions that cater to specific industry needs gives them a competitive edge in the market.

Furthermore, non-mega cap technology stocks are benefiting from the growing investor interest in disruptive technologies and emerging trends such as artificial intelligence, internet of things, cybersecurity, and cloud computing. These companies are often at the forefront of innovation in these areas, positioning them as attractive investment opportunities for those seeking exposure to high-growth sectors.

The RRG also reflects the changing market dynamics that favor non-mega cap technology stocks. As investors seek diversification and opportunities beyond the traditional tech giants, smaller tech companies are gaining attention for their growth potential and ability to generate outsized returns. The RRG serves as a valuable tool for identifying such opportunities and tracking the relative performance of non-mega cap technology stocks compared to their larger counterparts.

In conclusion, the RRG indicates that non-mega cap technology stocks are on the rise, driven by their focus on niche markets, ability to innovate, and alignment with emerging trends. As investors continue to seek opportunities in dynamic sectors such as technology, smaller tech companies are well-positioned to outperform and deliver value to those looking beyond the mega-cap giants. By leveraging the insights provided by the RRG, investors can identify promising investment opportunities in the non-mega cap technology space and capitalize on the potential for growth and outperformance in this segment of the market.

RRG Indicates That Non-Mega Cap Technology Stocks Are Improving

The Relative Rotation Graph (RRG) is a unique charting tool that helps investors visualize the relative strength and momentum of various sectors or asset classes. When analyzing the RRG for technology stocks, it is clear that non-mega cap technology stocks are showing signs of improvement compared to their larger counterparts.

At the forefront of this trend is the increasing demand for niche technology solutions and specialized services. While mega-cap technology companies like Apple, Amazon, and Microsoft dominate the headlines, smaller technology firms are carving out their own space in the market by focusing on specific areas of expertise. These companies are often more agile and innovative, allowing them to tap into emerging trends and meet the evolving needs of customers more quickly than their larger competitors.

Another factor driving the outperformance of non-mega cap technology stocks is the ongoing digital transformation across industries. As businesses and consumers increasingly rely on technology to streamline operations, improve efficiency, and enhance user experiences, smaller tech companies offering specialized products and services are well-positioned to capitalize on this trend. Their ability to provide tailored solutions that cater to specific industry needs gives them a competitive edge in the market.

Furthermore, non-mega cap technology stocks are benefiting from the growing investor interest in disruptive technologies and emerging trends such as artificial intelligence, internet of things, cybersecurity, and cloud computing. These companies are often at the forefront of innovation in these areas, positioning them as attractive investment opportunities for those seeking exposure to high-growth sectors.

The RRG also reflects the changing market dynamics that favor non-mega cap technology stocks. As investors seek diversification and opportunities beyond the traditional tech giants, smaller tech companies are gaining attention for their growth potential and ability to generate outsized returns. The RRG serves as a valuable tool for identifying such opportunities and tracking the relative performance of non-mega cap technology stocks compared to their larger counterparts.

In conclusion, the RRG indicates that non-mega cap technology stocks are on the rise, driven by their focus on niche markets, ability to innovate, and alignment with emerging trends. As investors continue to seek opportunities in dynamic sectors such as technology, smaller tech companies are well-positioned to outperform and deliver value to those looking beyond the mega-cap giants. By leveraging the insights provided by the RRG, investors can identify promising investment opportunities in the non-mega cap technology space and capitalize on the potential for growth and outperformance in this segment of the market.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry