Chasing Gains: Ride the Double Top Wave on Semiconductors (SMH)

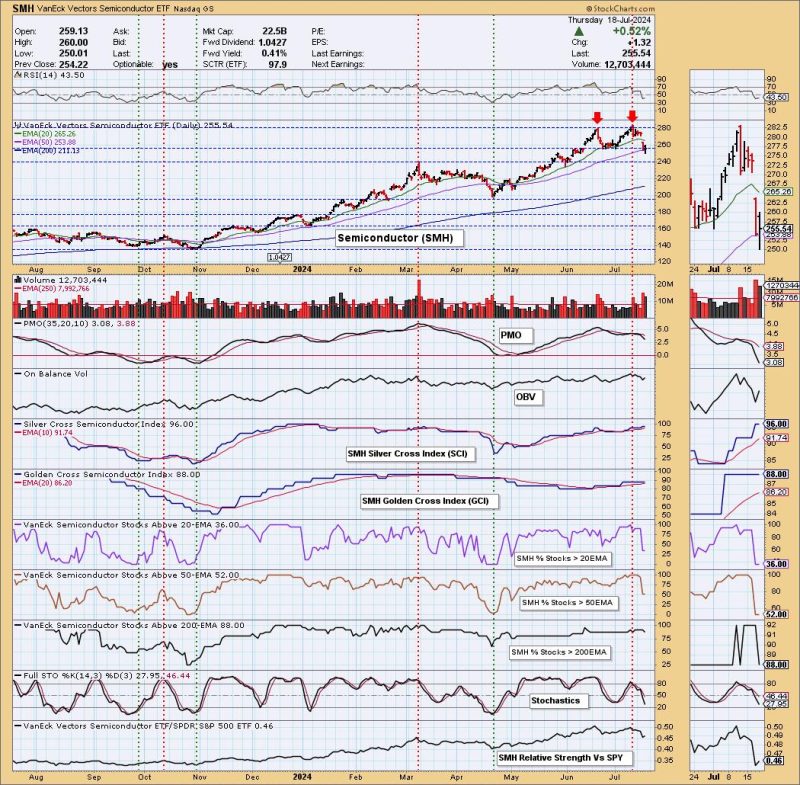

Double Top Pattern on Semiconductors (SMH)

The Double Top pattern is a popular technical analysis chart pattern that can signal a potential trend reversal. In the case of Semiconductors (SMH), this pattern can provide valuable insights for traders and investors looking to make informed decisions in the market.

Understanding the Double Top pattern is crucial for identifying potential changes in price direction. This pattern is characterized by two peaks at relatively the same price level, separated by a trough that acts as a support level. The formation of a Double Top pattern suggests that the price has reached a resistance level and is likely to reverse downwards.

In the context of Semiconductors (SMH), the Double Top pattern could indicate a potential reversal in the recent uptrend of the stock. As the price reaches a key resistance level, investors should pay close attention to the formation of the second peak and the subsequent price movement. If the price fails to break above the resistance level and forms a second peak, it could be a signal that the uptrend is losing momentum.

Traders and investors can use the Double Top pattern as a guide for setting entry and exit points in their trades. A common strategy is to enter a short position when the price breaks below the lowest point of the trough, confirming the pattern. This can help traders capitalize on the potential price decline following the Double Top formation.

It is important to note that while the Double Top pattern can be a reliable indicator of a trend reversal, it is not foolproof. Traders should use additional technical analysis tools and risk management strategies to confirm the signals provided by the pattern.

In conclusion, the Double Top pattern on Semiconductors (SMH) can offer valuable insights for traders and investors seeking to make informed decisions in the market. By understanding the characteristics of this pattern and using it in conjunction with other technical analysis tools, traders can enhance their trading strategies and improve their overall performance in the market.

Double Top Pattern on Semiconductors (SMH)

The Double Top pattern is a popular technical analysis chart pattern that can signal a potential trend reversal. In the case of Semiconductors (SMH), this pattern can provide valuable insights for traders and investors looking to make informed decisions in the market.

Understanding the Double Top pattern is crucial for identifying potential changes in price direction. This pattern is characterized by two peaks at relatively the same price level, separated by a trough that acts as a support level. The formation of a Double Top pattern suggests that the price has reached a resistance level and is likely to reverse downwards.

In the context of Semiconductors (SMH), the Double Top pattern could indicate a potential reversal in the recent uptrend of the stock. As the price reaches a key resistance level, investors should pay close attention to the formation of the second peak and the subsequent price movement. If the price fails to break above the resistance level and forms a second peak, it could be a signal that the uptrend is losing momentum.

Traders and investors can use the Double Top pattern as a guide for setting entry and exit points in their trades. A common strategy is to enter a short position when the price breaks below the lowest point of the trough, confirming the pattern. This can help traders capitalize on the potential price decline following the Double Top formation.

It is important to note that while the Double Top pattern can be a reliable indicator of a trend reversal, it is not foolproof. Traders should use additional technical analysis tools and risk management strategies to confirm the signals provided by the pattern.

In conclusion, the Double Top pattern on Semiconductors (SMH) can offer valuable insights for traders and investors seeking to make informed decisions in the market. By understanding the characteristics of this pattern and using it in conjunction with other technical analysis tools, traders can enhance their trading strategies and improve their overall performance in the market.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry