November 10, 2023

Investing in Grade Bonds with the McClellan Oscillator

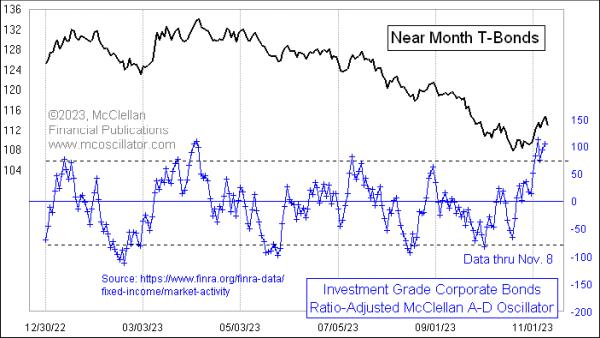

Investment grade bonds are a great way to diversify and build wealth. However, choosing the right bond and timing your purchase is important. One tool traders can use to help make these choices is the McClellan Oscillator. This indicator uses data from the bond market to provide information about the relative strength of investment grade bonds.

The McClellan Oscillator measures the sum of advancing and declining issues within an investment grade bond market. It does this by calculating the net amount of bonds posted on the American Stock Exchange and the New York Stock Exchange with spreads of less than 10 basis points. When there is an increase in the number of bonds posted this indicates increased demand from investors. When there is a decrease it indicates a lack of investor interest. By tracking the relative changes in the McClellan Oscillator, investors can get an idea of which investment grade bonds are stronger or weaker and analyze which ones may be good investments.

The McClellan Oscillator is an important tool for making informed decisions about investment grade bonds. It can be applied to any investment grade bond to measure strength. By tracking the changes in the oscillator, investors can better time their purchases so they can maximize their return on investment. Additionally, an analysis of trends in the oscillator can help determine if a particular investment grade bond is trending up or down and should be sold or kept.

Investment grade bonds are a great way to diversify and build wealth. However, choosing the right bond and timing your purchase is important. One tool traders can use to help make these choices is the McClellan Oscillator. This indicator uses data from the bond market to provide information about the relative strength of investment grade bonds.

The McClellan Oscillator measures the sum of advancing and declining issues within an investment grade bond market. It does this by calculating the net amount of bonds posted on the American Stock Exchange and the New York Stock Exchange with spreads of less than 10 basis points. When there is an increase in the number of bonds posted this indicates increased demand from investors. When there is a decrease it indicates a lack of investor interest. By tracking the relative changes in the McClellan Oscillator, investors can get an idea of which investment grade bonds are stronger or weaker and analyze which ones may be good investments.

The McClellan Oscillator is an important tool for making informed decisions about investment grade bonds. It can be applied to any investment grade bond to measure strength. By tracking the changes in the oscillator, investors can better time their purchases so they can maximize their return on investment. Additionally, an analysis of trends in the oscillator can help determine if a particular investment grade bond is trending up or down and should be sold or kept.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry