May 24, 2024

Market Is On the Verge of Topping Out

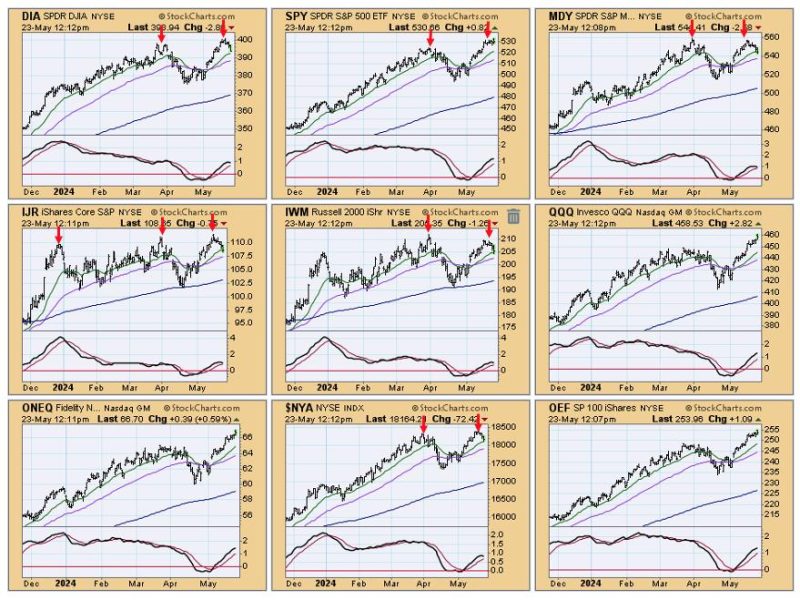

The market's recent performance has been characterized by multiple signs indicating that it may be on the verge of a top. These warnings are key to understand, as they suggest that a reversal may be approaching. Here are some indicators that the market looks toppy:

1. **Overextended Price Levels**: One clear sign that the market may be reaching a top is when prices have rallied too far, too fast. This can lead to stocks being overbought and vulnerable to a correction. In such situations, investors may become overly optimistic, driving prices to unsustainable levels.

2. **Lack of Positive Catalysts**: Another indication that the market is topping out is a lack of positive catalysts to drive further gains. When the market has already priced in all known positive news and is struggling to find new reasons to rally, it may struggle to sustain upward momentum.

3. **High Valuations**: High valuations across the board, whether measured by price-to-earnings ratios or other metrics, can contribute to a market top. When stocks are trading at historically high valuations, there is less room for further multiple expansion, making it challenging for prices to continue climbing.

4. **Increasing Volatility**: Rising volatility can be an early warning sign of a market top. As uncertainty and fear grow among investors, prices can become more erratic and vulnerable to sharp pullbacks. Increased volatility can also indicate that market participants are becoming more cautious and risk-averse.

5. **Divergence Among Sectors**: When certain sectors or industries start to underperform while others continue to rise, it can be a sign that the broader market is becoming fragmented and losing momentum. Divergence among sectors can signal that the rally is becoming narrow and unsustainable.

6. **Technical Indicators**: Technical analysis can also provide valuable insights into whether the market is topping out. Bearish chart patterns, such as double tops or head and shoulders formations, can suggest that the market is running out of steam and may be due for a pullback.

7. **Heavy Insider Selling**: Monitoring insider trading activity can offer clues about market sentiment. If insiders, such as company executives and large shareholders, are selling off their holdings in large volumes, it could indicate that they believe the market is overheated and poised for a correction.

8. **Weak Economic Data**: Weak economic data or signs of slowing growth can weigh on investor sentiment and contribute to a market top. If key economic indicators start to deteriorate, it can erode confidence in the strength of the economy and corporate earnings, leading to a market sell-off.

Overall, while these signs do not guarantee an imminent market top, they can serve as valuable warning signals for investors to exercise caution and consider adjusting their portfolios accordingly. Being mindful of these indicators and staying vigilant can help investors navigate uncertain market conditions and protect their investments from potential downturns.

The market's recent performance has been characterized by multiple signs indicating that it may be on the verge of a top. These warnings are key to understand, as they suggest that a reversal may be approaching. Here are some indicators that the market looks toppy:

1. **Overextended Price Levels**: One clear sign that the market may be reaching a top is when prices have rallied too far, too fast. This can lead to stocks being overbought and vulnerable to a correction. In such situations, investors may become overly optimistic, driving prices to unsustainable levels.

2. **Lack of Positive Catalysts**: Another indication that the market is topping out is a lack of positive catalysts to drive further gains. When the market has already priced in all known positive news and is struggling to find new reasons to rally, it may struggle to sustain upward momentum.

3. **High Valuations**: High valuations across the board, whether measured by price-to-earnings ratios or other metrics, can contribute to a market top. When stocks are trading at historically high valuations, there is less room for further multiple expansion, making it challenging for prices to continue climbing.

4. **Increasing Volatility**: Rising volatility can be an early warning sign of a market top. As uncertainty and fear grow among investors, prices can become more erratic and vulnerable to sharp pullbacks. Increased volatility can also indicate that market participants are becoming more cautious and risk-averse.

5. **Divergence Among Sectors**: When certain sectors or industries start to underperform while others continue to rise, it can be a sign that the broader market is becoming fragmented and losing momentum. Divergence among sectors can signal that the rally is becoming narrow and unsustainable.

6. **Technical Indicators**: Technical analysis can also provide valuable insights into whether the market is topping out. Bearish chart patterns, such as double tops or head and shoulders formations, can suggest that the market is running out of steam and may be due for a pullback.

7. **Heavy Insider Selling**: Monitoring insider trading activity can offer clues about market sentiment. If insiders, such as company executives and large shareholders, are selling off their holdings in large volumes, it could indicate that they believe the market is overheated and poised for a correction.

8. **Weak Economic Data**: Weak economic data or signs of slowing growth can weigh on investor sentiment and contribute to a market top. If key economic indicators start to deteriorate, it can erode confidence in the strength of the economy and corporate earnings, leading to a market sell-off.

Overall, while these signs do not guarantee an imminent market top, they can serve as valuable warning signals for investors to exercise caution and consider adjusting their portfolios accordingly. Being mindful of these indicators and staying vigilant can help investors navigate uncertain market conditions and protect their investments from potential downturns.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry