March 22, 2024

Master Market Trends with Advanced Technical Indicators – Part 2 of Market Research Series

In today's highly competitive business environment, market research and analysis play a crucial role in strategizing and decision-making processes. In Part 1 of this series, we discussed the importance of market research and the fundamental concepts involved. In Part 2, we delve into the realm of using technical indicators to further enhance the effectiveness of market analysis.

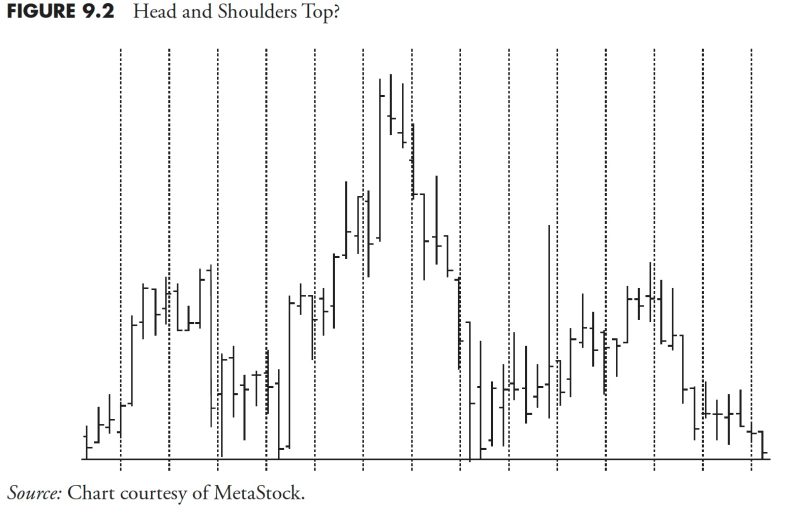

Technical indicators are powerful tools that help traders and analysts gain insights into market trends, price movements, and potential future directions based on historical data. These indicators are quantitative tools that use mathematical calculations to process market data and provide visual representations that aid in making informed trading decisions. By analyzing price and volume data, technical indicators can help identify patterns, trends, and potential turning points in the market.

There is a wide range of technical indicators available, each serving a distinct purpose and providing unique insights into market behavior. Some of the commonly used technical indicators include Moving Averages, Relative Strength Index (RSI), Stochastic Oscillator, MACD (Moving Average Convergence Divergence), and Bollinger Bands, among others.

Moving Averages are one of the simplest yet most effective technical indicators. They smooth out price data to create a single flowing line, which helps identify the direction of a trend. Traders often use the crossover of different moving averages to signal potential buying or selling opportunities.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are used to identify overbought or oversold conditions in the market. A reading above 70 suggests the market is overbought, while a reading below 30 indicates oversold conditions.

The Stochastic Oscillator is another momentum indicator that compares a security's closing price to its price range over a specific period of time. It generates values between 0 and 100 and is used to identify potential trend reversals based on overbought or oversold conditions.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. Traders look for MACD crossovers to signal changes in the strength and direction of a trend.

Bollinger Bands consist of a simple moving average (SMA) and two standard deviations plotted above and below the SMA. They help traders identify volatility and potential price breakouts based on the width of the bands.

While these technical indicators can be powerful tools for analyzing market data, it is important to use them in conjunction with other forms of analysis and risk management strategies. It is also essential to understand the limitations of each indicator and avoid relying solely on them for making trading decisions.

In conclusion, technical indicators are valuable instruments that can provide valuable insights into market trends and price movements. By incorporating these indicators into your market research and analysis processes, you can enhance your ability to make informed trading decisions and improve your overall performance in the market.

In today's highly competitive business environment, market research and analysis play a crucial role in strategizing and decision-making processes. In Part 1 of this series, we discussed the importance of market research and the fundamental concepts involved. In Part 2, we delve into the realm of using technical indicators to further enhance the effectiveness of market analysis.

Technical indicators are powerful tools that help traders and analysts gain insights into market trends, price movements, and potential future directions based on historical data. These indicators are quantitative tools that use mathematical calculations to process market data and provide visual representations that aid in making informed trading decisions. By analyzing price and volume data, technical indicators can help identify patterns, trends, and potential turning points in the market.

There is a wide range of technical indicators available, each serving a distinct purpose and providing unique insights into market behavior. Some of the commonly used technical indicators include Moving Averages, Relative Strength Index (RSI), Stochastic Oscillator, MACD (Moving Average Convergence Divergence), and Bollinger Bands, among others.

Moving Averages are one of the simplest yet most effective technical indicators. They smooth out price data to create a single flowing line, which helps identify the direction of a trend. Traders often use the crossover of different moving averages to signal potential buying or selling opportunities.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are used to identify overbought or oversold conditions in the market. A reading above 70 suggests the market is overbought, while a reading below 30 indicates oversold conditions.

The Stochastic Oscillator is another momentum indicator that compares a security's closing price to its price range over a specific period of time. It generates values between 0 and 100 and is used to identify potential trend reversals based on overbought or oversold conditions.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. Traders look for MACD crossovers to signal changes in the strength and direction of a trend.

Bollinger Bands consist of a simple moving average (SMA) and two standard deviations plotted above and below the SMA. They help traders identify volatility and potential price breakouts based on the width of the bands.

While these technical indicators can be powerful tools for analyzing market data, it is important to use them in conjunction with other forms of analysis and risk management strategies. It is also essential to understand the limitations of each indicator and avoid relying solely on them for making trading decisions.

In conclusion, technical indicators are valuable instruments that can provide valuable insights into market trends and price movements. By incorporating these indicators into your market research and analysis processes, you can enhance your ability to make informed trading decisions and improve your overall performance in the market.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry