April 26, 2024

Mastering Market Metrics: Leveling Up Your Rules-Based Money Management (Part 2)

Market Sentiment Indicators

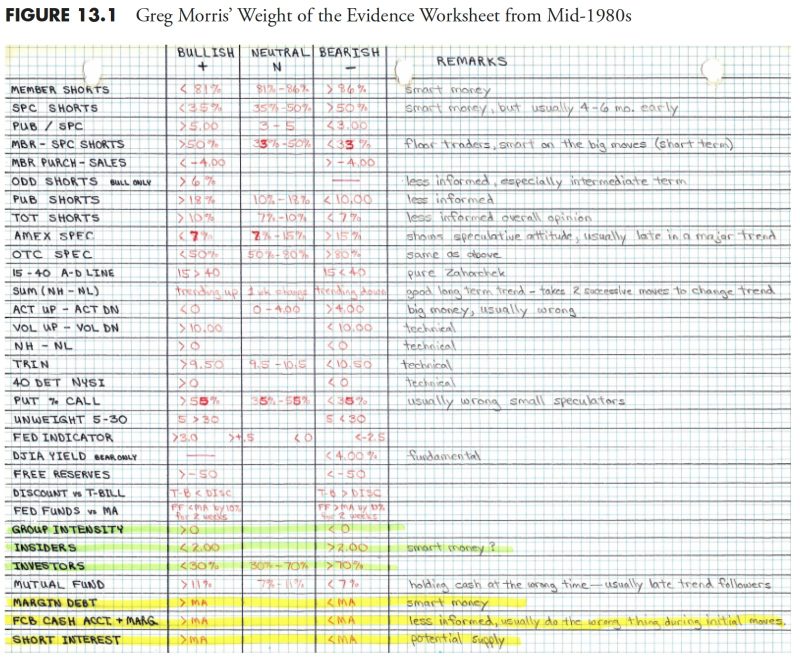

In rules-based money management, accurate market analysis is crucial for making informed decisions. One key aspect of measuring the market is assessing market sentiment. Market sentiment refers to the overall attitude or feeling of investors towards a particular asset or market. By understanding market sentiment, traders can gain valuable insights into potential market movements. Here are some popular market sentiment indicators used in rules-based money management:

1. Put/Call Ratio - The put/call ratio is a popular sentiment indicator that measures the volume of put options versus call options traded on an underlying asset. A high put/call ratio indicates bearish sentiment, suggesting that investors are more inclined towards buying put options to profit from potential price declines. Conversely, a low put/call ratio suggests bullish sentiment, as investors are more interested in buying call options to benefit from price increases.

2. Volatility Index (VIX) - The VIX, also known as the fear gauge, measures implied volatility in the options market. A high VIX value indicates increased market uncertainty and fear, suggesting a higher likelihood of market declines. On the other hand, a low VIX value signals lower market uncertainty and complacency, indicating a greater chance of market rallies.

3. Bull/Bear Index - The Bull/Bear Index compares the sentiment of market newsletter writers who are bullish versus those who are bearish. A high Bull/Bear ratio signifies extreme bullish sentiment, indicating a potential overbought market condition and vice versa. Traders can use this indicator to gauge market sentiment extremes and anticipate trend reversals.

4. Short Interest Ratio - The short interest ratio measures the number of shares sold short relative to the total outstanding shares. A high short interest ratio suggests bearish sentiment, as investors are betting on a decline in the stock price. Conversely, a low short interest ratio indicates bullish sentiment, as there are fewer investors expecting price decreases.

5. Insider Trading Activity - Monitoring insider trading activity, where corporate insiders buy or sell shares of their own company, can provide valuable insights into market sentiment. Significant purchases by insiders may indicate confidence in the company's future prospects, suggesting bullish sentiment. Conversely, widespread insider selling could signal bearish sentiment and potential downside risks.

By incorporating these market sentiment indicators into a rules-based money management strategy, traders can better assess market conditions, identify potential opportunities, and manage risk effectively. Remember, while market sentiment indicators provide valuable insights, it is essential to use them in conjunction with other technical and fundamental analysis tools for comprehensive market evaluation and decision-making.

Market Sentiment Indicators

In rules-based money management, accurate market analysis is crucial for making informed decisions. One key aspect of measuring the market is assessing market sentiment. Market sentiment refers to the overall attitude or feeling of investors towards a particular asset or market. By understanding market sentiment, traders can gain valuable insights into potential market movements. Here are some popular market sentiment indicators used in rules-based money management:

1. Put/Call Ratio - The put/call ratio is a popular sentiment indicator that measures the volume of put options versus call options traded on an underlying asset. A high put/call ratio indicates bearish sentiment, suggesting that investors are more inclined towards buying put options to profit from potential price declines. Conversely, a low put/call ratio suggests bullish sentiment, as investors are more interested in buying call options to benefit from price increases.

2. Volatility Index (VIX) - The VIX, also known as the fear gauge, measures implied volatility in the options market. A high VIX value indicates increased market uncertainty and fear, suggesting a higher likelihood of market declines. On the other hand, a low VIX value signals lower market uncertainty and complacency, indicating a greater chance of market rallies.

3. Bull/Bear Index - The Bull/Bear Index compares the sentiment of market newsletter writers who are bullish versus those who are bearish. A high Bull/Bear ratio signifies extreme bullish sentiment, indicating a potential overbought market condition and vice versa. Traders can use this indicator to gauge market sentiment extremes and anticipate trend reversals.

4. Short Interest Ratio - The short interest ratio measures the number of shares sold short relative to the total outstanding shares. A high short interest ratio suggests bearish sentiment, as investors are betting on a decline in the stock price. Conversely, a low short interest ratio indicates bullish sentiment, as there are fewer investors expecting price decreases.

5. Insider Trading Activity - Monitoring insider trading activity, where corporate insiders buy or sell shares of their own company, can provide valuable insights into market sentiment. Significant purchases by insiders may indicate confidence in the company's future prospects, suggesting bullish sentiment. Conversely, widespread insider selling could signal bearish sentiment and potential downside risks.

By incorporating these market sentiment indicators into a rules-based money management strategy, traders can better assess market conditions, identify potential opportunities, and manage risk effectively. Remember, while market sentiment indicators provide valuable insights, it is essential to use them in conjunction with other technical and fundamental analysis tools for comprehensive market evaluation and decision-making.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry