August 2, 2024

The Fed’s Nightmare: Unbelievable Puppetry at Play

The Federal Reserve, commonly referred to as the Fed, plays a crucial role in the United States economy by setting monetary policy to achieve maximum employment, stable prices, and moderate long-term interest rates. However, recent actions taken by the Fed have raised concerns and led to apprehensions about the potential long-term consequences for the economy.

One of the primary functions of the Fed is to control the money supply to regulate economic growth. In response to the economic fallout from the COVID-19 pandemic, the Fed implemented unprecedented measures to support the economy, including slashing interest rates to near zero and purchasing large quantities of government bonds and mortgage-backed securities. While these actions were initially intended to stimulate economic activity and prevent a financial crisis, they have inadvertently created a dilemma for the Fed.

By flooding the financial system with liquidity and driving down interest rates, the Fed has artificially inflated asset prices and spurred excessive risk-taking in the financial markets. Investors, seeking higher returns in a low-interest rate environment, have poured money into equities, corporate bonds, and other risky assets, driving valuations to unsustainable levels. This has created a bubble in the financial markets that could burst, leading to a sharp correction and potentially triggering a broader economic downturn.

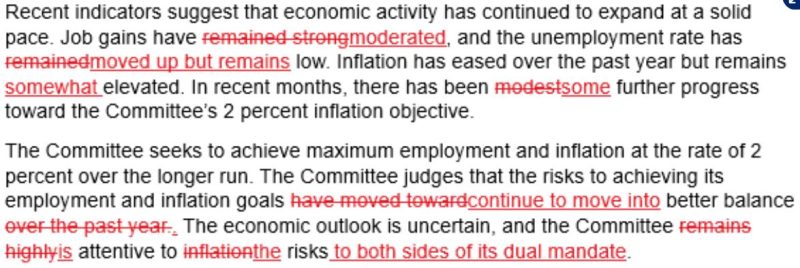

Moreover, the Fed's aggressive monetary policy has fueled concerns about inflation. As the economy reopens and demand for goods and services rebounds, there is a risk that prices could rise at a faster pace than expected, eroding the purchasing power of consumers and undermining the Fed's credibility in maintaining price stability. Inflationary pressures could force the Fed to tighten monetary policy sooner than anticipated, potentially derailing the fragile economic recovery.

Another issue facing the Fed is its growing balance sheet, which has expanded significantly as a result of its asset purchase programs. The Fed's balance sheet now stands at over $8 trillion, more than double its size before the pandemic. While expanding the balance sheet was necessary to support the economy during the crisis, the Fed now faces the challenge of unwinding its massive holdings without causing disruption in the financial markets or sparking a sharp rise in interest rates.

Overall, the Fed finds itself in a delicate balancing act, trying to support the economy in the short term while avoiding unintended consequences in the long term. As the central bank continues to navigate these challenges, it must remain vigilant and be prepared to adjust its policy stance to ensure a sustainable and stable economic recovery. Failure to do so could lead to dire consequences for the economy and financial markets, creating a nightmare scenario that we, as the puppets of the Fed's policies, would ultimately bear the brunt of.

The Federal Reserve, commonly referred to as the Fed, plays a crucial role in the United States economy by setting monetary policy to achieve maximum employment, stable prices, and moderate long-term interest rates. However, recent actions taken by the Fed have raised concerns and led to apprehensions about the potential long-term consequences for the economy.

One of the primary functions of the Fed is to control the money supply to regulate economic growth. In response to the economic fallout from the COVID-19 pandemic, the Fed implemented unprecedented measures to support the economy, including slashing interest rates to near zero and purchasing large quantities of government bonds and mortgage-backed securities. While these actions were initially intended to stimulate economic activity and prevent a financial crisis, they have inadvertently created a dilemma for the Fed.

By flooding the financial system with liquidity and driving down interest rates, the Fed has artificially inflated asset prices and spurred excessive risk-taking in the financial markets. Investors, seeking higher returns in a low-interest rate environment, have poured money into equities, corporate bonds, and other risky assets, driving valuations to unsustainable levels. This has created a bubble in the financial markets that could burst, leading to a sharp correction and potentially triggering a broader economic downturn.

Moreover, the Fed's aggressive monetary policy has fueled concerns about inflation. As the economy reopens and demand for goods and services rebounds, there is a risk that prices could rise at a faster pace than expected, eroding the purchasing power of consumers and undermining the Fed's credibility in maintaining price stability. Inflationary pressures could force the Fed to tighten monetary policy sooner than anticipated, potentially derailing the fragile economic recovery.

Another issue facing the Fed is its growing balance sheet, which has expanded significantly as a result of its asset purchase programs. The Fed's balance sheet now stands at over $8 trillion, more than double its size before the pandemic. While expanding the balance sheet was necessary to support the economy during the crisis, the Fed now faces the challenge of unwinding its massive holdings without causing disruption in the financial markets or sparking a sharp rise in interest rates.

Overall, the Fed finds itself in a delicate balancing act, trying to support the economy in the short term while avoiding unintended consequences in the long term. As the central bank continues to navigate these challenges, it must remain vigilant and be prepared to adjust its policy stance to ensure a sustainable and stable economic recovery. Failure to do so could lead to dire consequences for the economy and financial markets, creating a nightmare scenario that we, as the puppets of the Fed's policies, would ultimately bear the brunt of.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry