March 8, 2024

Trade and Trend: Mastering with ATR Trailing Stop!

The Average True Range (ATR) trailing stop is a powerful tool that can be used to manage trades effectively while defining the trend in the market. This indicator is popular among traders due to its ability to dynamically adjust stop loss levels based on the volatility of the asset being traded. By incorporating the ATR trailing stop into your trading strategy, you can improve your risk management and maximize your profit potential.

1. Understanding the ATR Trailing Stop

The ATR trailing stop is based on the Average True Range indicator, which measures the volatility of an asset over a given period. The ATR calculates the average range between the high and low prices of each candlestick, providing insight into the level of price fluctuation in the market. By using the ATR to set trailing stops, traders can adjust their stop loss levels in accordance with the changing market conditions.

2. Managing Trades with the ATR Trailing Stop

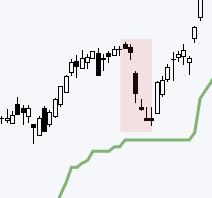

One of the key benefits of the ATR trailing stop is its ability to protect profits while allowing for potential price increases. As the asset's price moves in the desired direction, the trailing stop will automatically adjust to lock in gains and prevent unnecessary losses. Traders can set the ATR multiplier to determine the distance between the current price and the trailing stop level, with a higher multiplier accommodating greater price fluctuations.

3. Defining the Trend with the ATR Trailing Stop

In addition to managing trades, the ATR trailing stop can also help traders identify the prevailing trend in the market. By observing the distance between the price and the trailing stop, traders can gauge the strength and direction of the trend. A widening gap between the price and the trailing stop suggests a strong trend, while a narrowing gap may indicate a potential reversal.

4. Implementing the ATR Trailing Stop in Trading Strategies

To integrate the ATR trailing stop into your trading strategy, start by identifying the appropriate time frame and period for the ATR indicator. Shorter time frames and periods will produce more responsive trailing stops, while longer time frames and periods will generate more stable trailing stops. Experiment with different settings to find the optimal configuration for your trading style and risk tolerance.

5. Conclusion

The ATR trailing stop is a versatile tool that can enhance your trading performance by effectively managing trades and defining market trends. By incorporating this indicator into your trading strategy, you can improve your risk management, protect profits, and capitalize on potential price movements. Experiment with different settings and practice using the ATR trailing stop in a demo account before applying it to live trading. With the right approach, the ATR trailing stop can become a valuable asset in your trading toolkit.

The Average True Range (ATR) trailing stop is a powerful tool that can be used to manage trades effectively while defining the trend in the market. This indicator is popular among traders due to its ability to dynamically adjust stop loss levels based on the volatility of the asset being traded. By incorporating the ATR trailing stop into your trading strategy, you can improve your risk management and maximize your profit potential.

1. Understanding the ATR Trailing Stop

The ATR trailing stop is based on the Average True Range indicator, which measures the volatility of an asset over a given period. The ATR calculates the average range between the high and low prices of each candlestick, providing insight into the level of price fluctuation in the market. By using the ATR to set trailing stops, traders can adjust their stop loss levels in accordance with the changing market conditions.

2. Managing Trades with the ATR Trailing Stop

One of the key benefits of the ATR trailing stop is its ability to protect profits while allowing for potential price increases. As the asset's price moves in the desired direction, the trailing stop will automatically adjust to lock in gains and prevent unnecessary losses. Traders can set the ATR multiplier to determine the distance between the current price and the trailing stop level, with a higher multiplier accommodating greater price fluctuations.

3. Defining the Trend with the ATR Trailing Stop

In addition to managing trades, the ATR trailing stop can also help traders identify the prevailing trend in the market. By observing the distance between the price and the trailing stop, traders can gauge the strength and direction of the trend. A widening gap between the price and the trailing stop suggests a strong trend, while a narrowing gap may indicate a potential reversal.

4. Implementing the ATR Trailing Stop in Trading Strategies

To integrate the ATR trailing stop into your trading strategy, start by identifying the appropriate time frame and period for the ATR indicator. Shorter time frames and periods will produce more responsive trailing stops, while longer time frames and periods will generate more stable trailing stops. Experiment with different settings to find the optimal configuration for your trading style and risk tolerance.

5. Conclusion

The ATR trailing stop is a versatile tool that can enhance your trading performance by effectively managing trades and defining market trends. By incorporating this indicator into your trading strategy, you can improve your risk management, protect profits, and capitalize on potential price movements. Experiment with different settings and practice using the ATR trailing stop in a demo account before applying it to live trading. With the right approach, the ATR trailing stop can become a valuable asset in your trading toolkit.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry