December 1, 2023

Unlock the Mysteries of Put/Call Ratio on Weird Wednesdays!

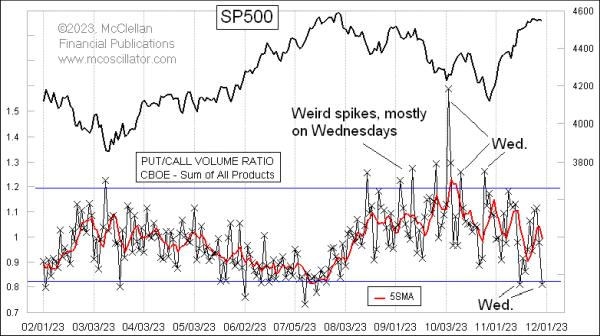

Weird Wednesdays has become a popular tradition at the trading desk. What is the Put/Call Ratio and what does it mean? The Put/Call Ratio is the ratio of outstanding put options contracts to outstanding call options contracts which are traded on the options market. Essentially, the higher the Put/Call Ratio, the more traders are interested in selling options rather than buying them. It is an indicator of how sentiment in the markets is running at the time.

Traders often monitor the Put/Call Ratio to determine market sentiment. A high Put/Call Ratio indicates that bearish sentiment dominates the markets; conversely, a low Put/Call Ratio indicates bullish sentiment in the markets. The Put/Call Ratio is an important indicator in the options market, as it can give traders an insight into the possible direction of the markets in the near future.

Weird Wednesdays is a tradition where traders take a look at the Put/Call Ratio for the day to help gauge the sentiment of traders in the options market. Traders can then use that information to decide how to best react to the current market situation. By monitoring the Put/Call Ratio, traders can be better positioned to make the right trading decisions.

Weird Wednesdays is a fun, interesting way to stay on top of the markets and understand the overall sentiment in the options trading marketplace. By taking a look at the Put/Call Ratio each Wednesday, traders can gain insight into which way the market is headed, allowing them to make more informed trading decisions. The Put/Call Ratio can be a powerful tool for trading success, and Weird Wednesdays is an important tradition in the options trading arena.

Weird Wednesdays has become a popular tradition at the trading desk. What is the Put/Call Ratio and what does it mean? The Put/Call Ratio is the ratio of outstanding put options contracts to outstanding call options contracts which are traded on the options market. Essentially, the higher the Put/Call Ratio, the more traders are interested in selling options rather than buying them. It is an indicator of how sentiment in the markets is running at the time.

Traders often monitor the Put/Call Ratio to determine market sentiment. A high Put/Call Ratio indicates that bearish sentiment dominates the markets; conversely, a low Put/Call Ratio indicates bullish sentiment in the markets. The Put/Call Ratio is an important indicator in the options market, as it can give traders an insight into the possible direction of the markets in the near future.

Weird Wednesdays is a tradition where traders take a look at the Put/Call Ratio for the day to help gauge the sentiment of traders in the options market. Traders can then use that information to decide how to best react to the current market situation. By monitoring the Put/Call Ratio, traders can be better positioned to make the right trading decisions.

Weird Wednesdays is a fun, interesting way to stay on top of the markets and understand the overall sentiment in the options trading marketplace. By taking a look at the Put/Call Ratio each Wednesday, traders can gain insight into which way the market is headed, allowing them to make more informed trading decisions. The Put/Call Ratio can be a powerful tool for trading success, and Weird Wednesdays is an important tradition in the options trading arena.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry