April 26, 2024

Unlocking the Potential: Value Stocks Surge with 10% Downside Risk for Market

10% Downside Risk For Stocks as Value Takes The Lead

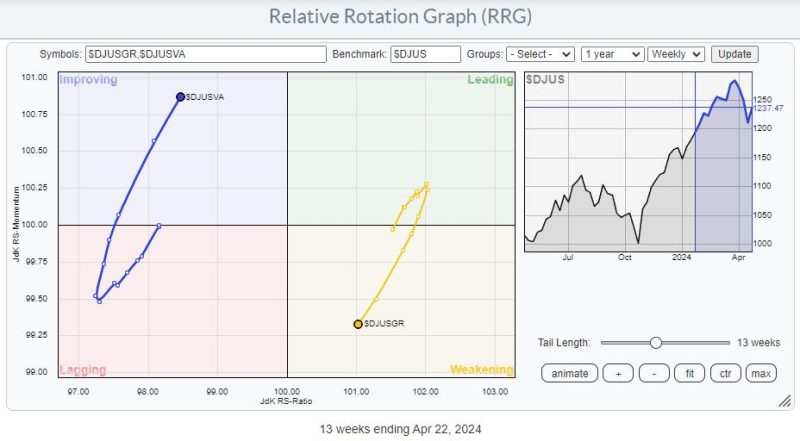

Market analysts have been closely monitoring the recent shift in market dynamics as value stocks continue to outperform growth stocks, prompting a growing concern over a potential downside risk in the stock market. With value stocks gaining traction and leading the way, investors are beginning to brace themselves for a potential correction that could see stock prices declining by up to 10%.

The resurgence of value stocks can be attributed to several factors, including an improving economic outlook, rising inflation expectations, and shifting investor sentiment towards more traditional and stable companies. Value stocks, which typically represent companies with strong fundamentals and a sound business model, have been attracting more attention as investors seek to diversify their portfolios and mitigate risks associated with high-flying growth stocks.

However, as value stocks continue to rally and outperform growth stocks, concerns have emerged about a potential market correction that could erase recent gains and lead to a significant downside risk for stocks. Market analysts point to various indicators that suggest a possible pullback in the market, including overextended valuations, rising interest rates, and lingering uncertainties surrounding global events such as the geopolitical tensions and the ongoing pandemic.

Moreover, the recent market volatility and increased investor caution have further fueled concerns about a potential downside risk in the stock market. While some market participants remain optimistic about the overall market outlook, others are adopting a more cautious approach and reevaluating their investment strategies in anticipation of a possible correction.

In light of these developments, many investors are considering various risk management strategies to protect their portfolios from potential downside risks. These strategies may include diversifying investments across different asset classes, rebalancing portfolios to reduce exposure to high-risk assets, and implementing hedging techniques to mitigate potential losses in the event of a market downturn.

Overall, the current market dynamics suggest that investors should carefully assess their risk tolerance and portfolio allocations to navigate the evolving market environment successfully. While value stocks may continue to outperform in the short term, the looming downside risk in the stock market underscores the importance of staying vigilant and adopting prudent risk management practices to safeguard investments in an increasingly volatile market environment.

10% Downside Risk For Stocks as Value Takes The Lead

Market analysts have been closely monitoring the recent shift in market dynamics as value stocks continue to outperform growth stocks, prompting a growing concern over a potential downside risk in the stock market. With value stocks gaining traction and leading the way, investors are beginning to brace themselves for a potential correction that could see stock prices declining by up to 10%.

The resurgence of value stocks can be attributed to several factors, including an improving economic outlook, rising inflation expectations, and shifting investor sentiment towards more traditional and stable companies. Value stocks, which typically represent companies with strong fundamentals and a sound business model, have been attracting more attention as investors seek to diversify their portfolios and mitigate risks associated with high-flying growth stocks.

However, as value stocks continue to rally and outperform growth stocks, concerns have emerged about a potential market correction that could erase recent gains and lead to a significant downside risk for stocks. Market analysts point to various indicators that suggest a possible pullback in the market, including overextended valuations, rising interest rates, and lingering uncertainties surrounding global events such as the geopolitical tensions and the ongoing pandemic.

Moreover, the recent market volatility and increased investor caution have further fueled concerns about a potential downside risk in the stock market. While some market participants remain optimistic about the overall market outlook, others are adopting a more cautious approach and reevaluating their investment strategies in anticipation of a possible correction.

In light of these developments, many investors are considering various risk management strategies to protect their portfolios from potential downside risks. These strategies may include diversifying investments across different asset classes, rebalancing portfolios to reduce exposure to high-risk assets, and implementing hedging techniques to mitigate potential losses in the event of a market downturn.

Overall, the current market dynamics suggest that investors should carefully assess their risk tolerance and portfolio allocations to navigate the evolving market environment successfully. While value stocks may continue to outperform in the short term, the looming downside risk in the stock market underscores the importance of staying vigilant and adopting prudent risk management practices to safeguard investments in an increasingly volatile market environment.

If you would like to delve into the world of investment topics , go to our partner project Wall Street Wizardry